Who is leading the 5G patent race?

A patent landscape analysis on declared SEPs and standards contributions

April 2019

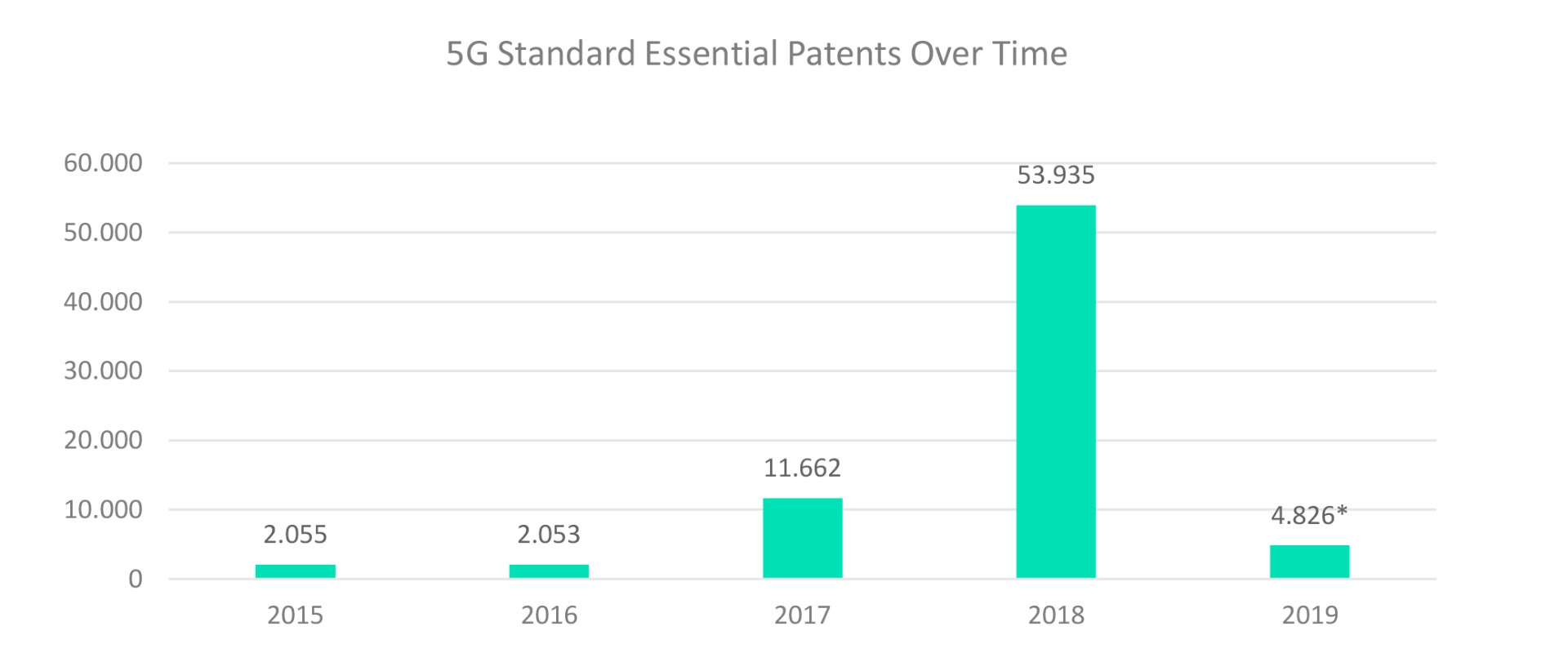

The long-term vision is that 5G will empower the invention of thousands of new products, technologies and services, increase productivity and allow for new industries to emerge. A global 5G network will unify mobile communication in order to connect individuals or devices to everything through the Internet of Things (IoT). 5G technologies will connect vehicles, ships, buildings, meters, machines and other items with electronics, software, sensors and the cloud. Embedded 5G technologies will e.g. allow machines to exchange information yielding a direct integration of the physical world into computer-based systems. The past years have shown that patent owners for 3G and 4G controlled how mobile technologies were used in the smart phone industry. Thus, also 5G patent owners will likely become technology and market leaders to enable 5G connectivity in various markets. Using the database and analytics of the IPlytics Platform tool, table 1 illustrates an increasing number of 5G declared standard essential patents over the past 4 years. Standard essential patents (SEPs) are those that any company will have to use when implementing the standardized 5G technology. The numbers show a sharp increase arriving at over sixty thousand 5G SEPs.

Table 1: Yearly number of declared standard essential patents for 5G as to declaration date

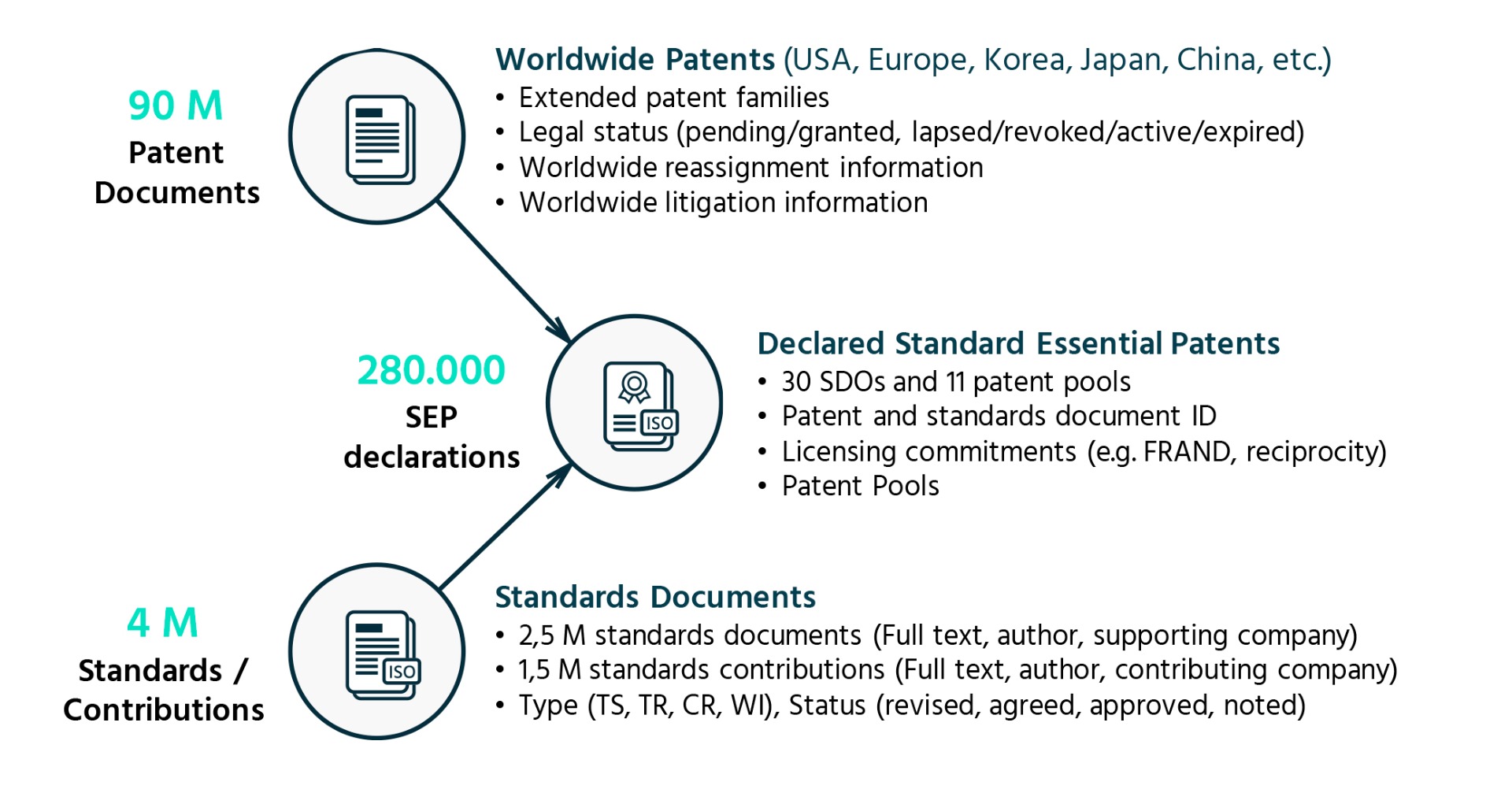

The analysis was based on state-of-the-art stemming and semantic indexing methods searching in full text declared SEPs patent documents as well as in full text standards and contribution documents. Figure 1 illustrates how the data on patents, declared SEPs, standards and contribution documents is structured.

Figure 1. Data integration of patents, declared SEPs, standards and contributions

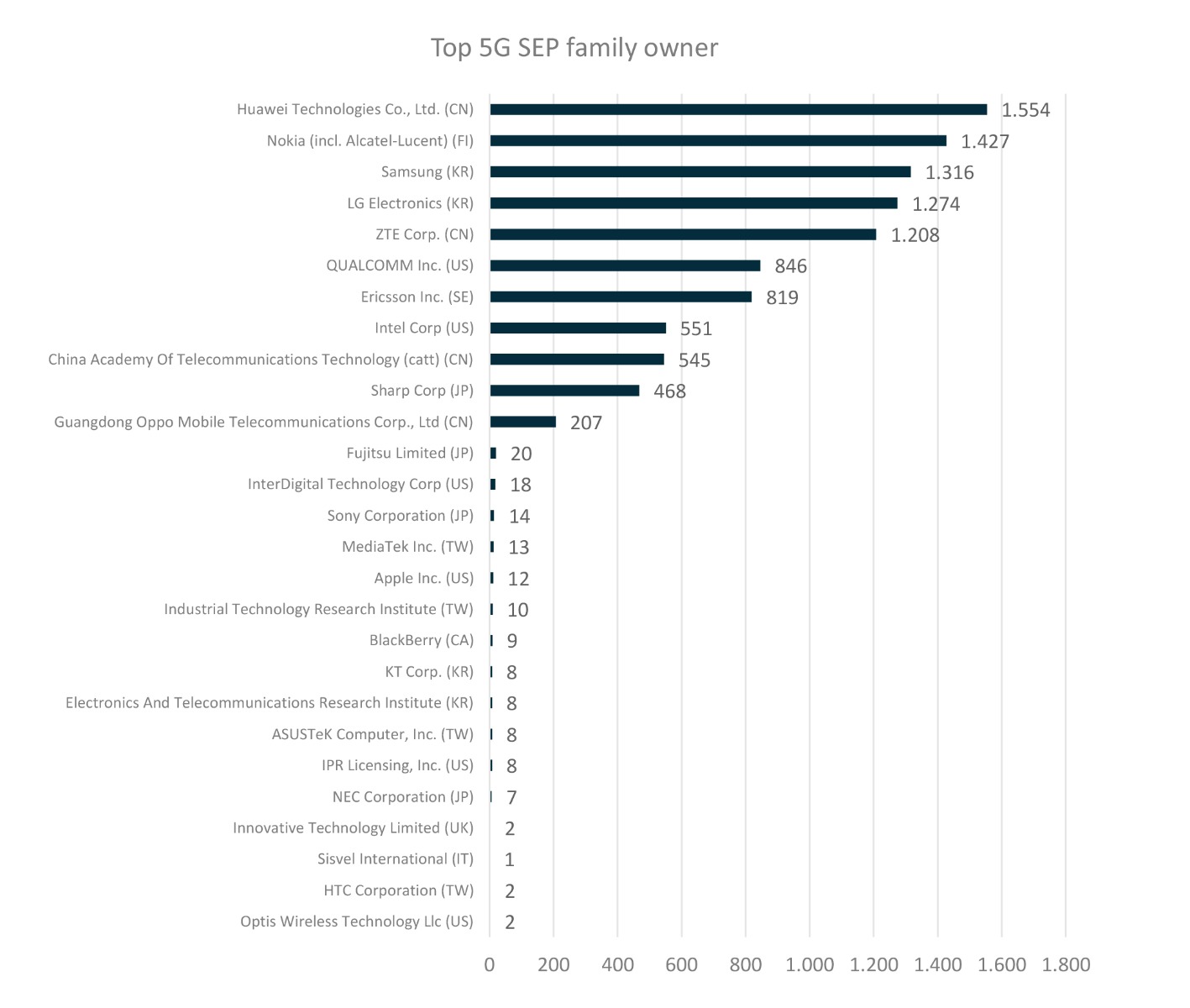

While the implementation of 3G and 4G mainly concerned the smart phone industry, 5G will enable such connectivity in the whole physical world through e.g. the Internet of Things (IoT). In future, any sector subject to connectivity e.g. transport, energy, manufacturing, healthcare or entertainment will make use of 5G and thus also use 5G standard essential patents. Successful 3G and 4G patent licensing programs have provided evidence that patent royalty incomes are highly lucrative and the target market for licensing 5G patents will even increase since 5G patent holders will be able to extend their licensing program to various use cases beyond smart phones. Using the database and analytics of the IPlytics Platform tool, table 2 illustrates the top patent owner of declared standard essential 5G patents. The Chinese company Huawei has the largest portfolio followed by the Finish company Nokia and the South Korean companies Samsung and LG. Qualcomm and Intel are the largest US companies holding 5G SEPs, Sharp and Fujitsu are the largest Japanese 5G SEP owners.

Table 2: Top 5G standard essential patent owner as to the number of patent families

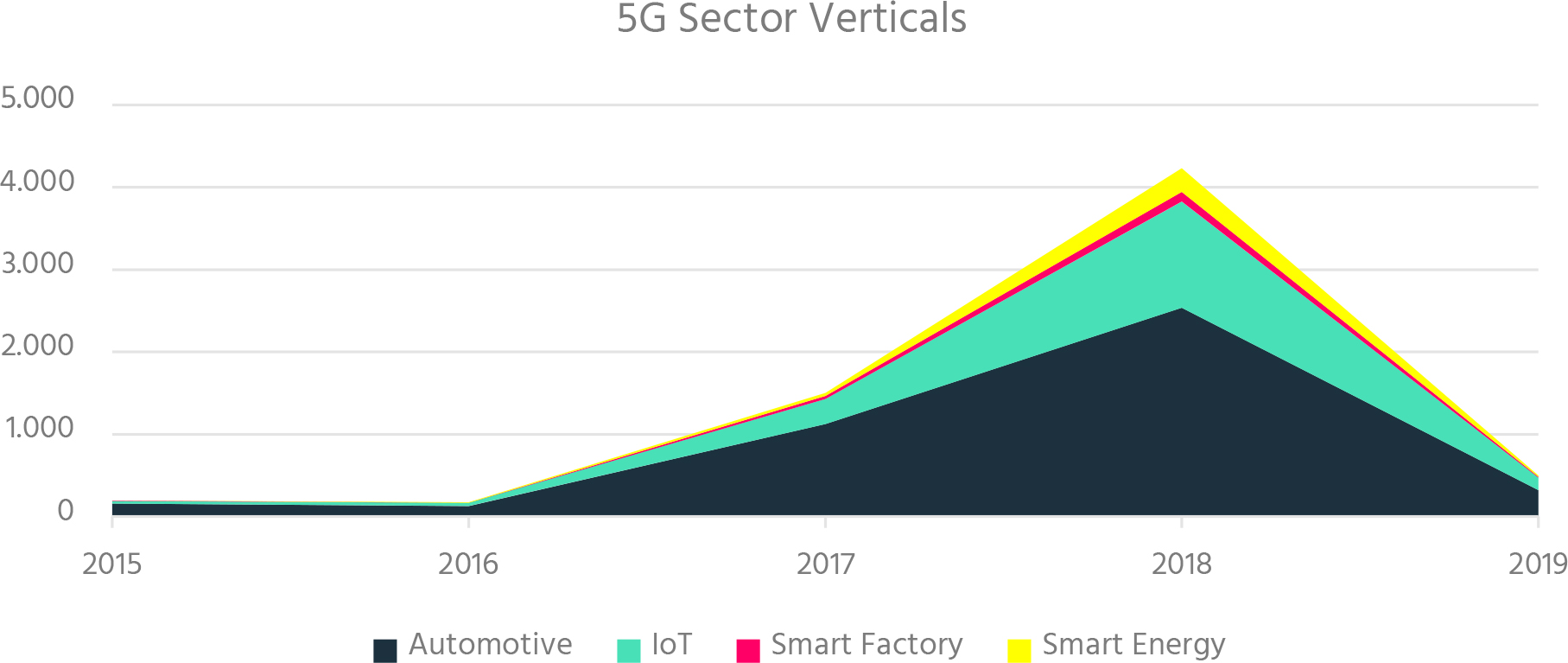

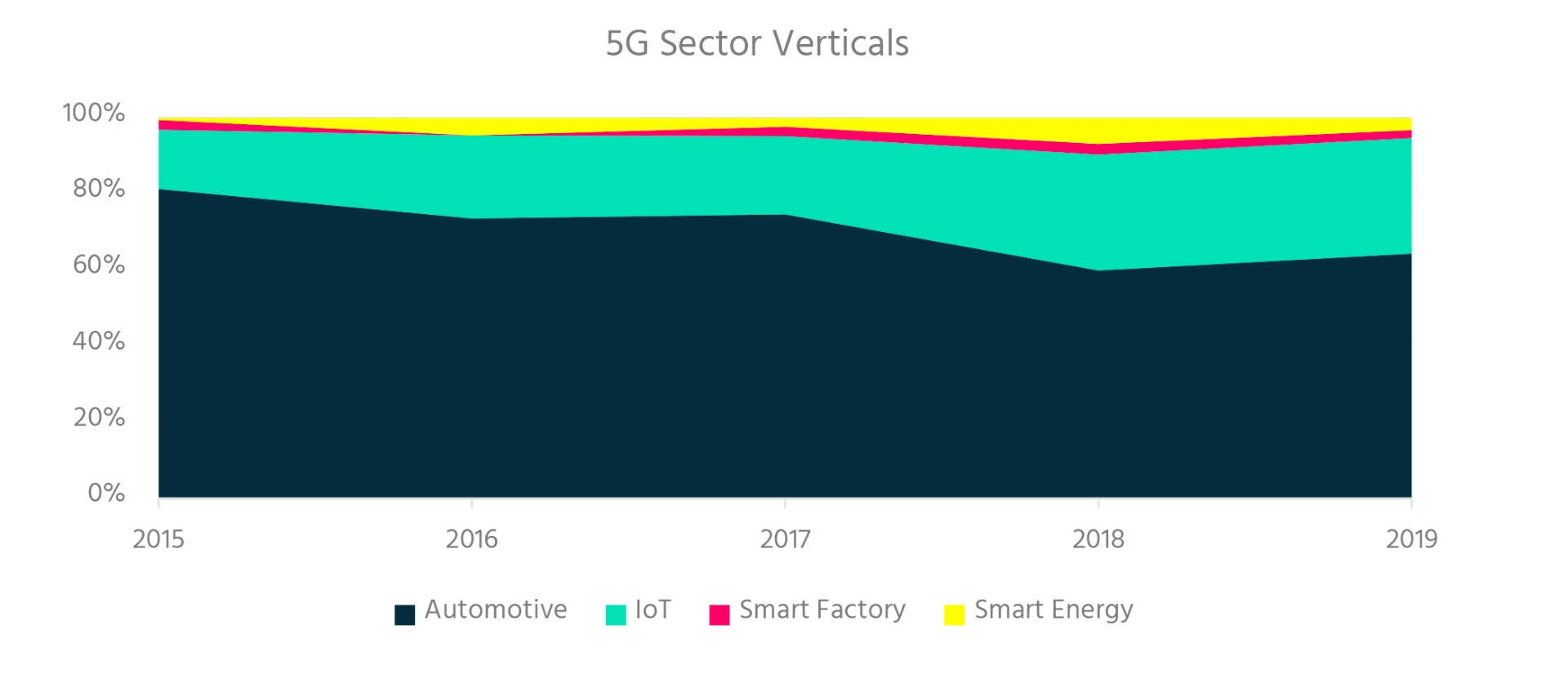

The automotive industry will most likely be one of the first industries to rely on 5G, connecting vehicles to other vehicles, roadsides, traffic lights, buildings and the Internet to process data across cars or in the cloud. But also, the smart factory of the future will use 5G technologies for machine-to-machine communication, connected 3D printing or augmented reality production. IoT (Internet of Things) technologies will allow connectivity of sensors and data clouds. Smart energy technologies allow more intelligent management of meters and energy consumption. Table 3 illustrates 5G standard essential patents classified as to the industry application field. The number of %G SEPs for the automotive application of 5G is by far the largest, followed by IoT, smart energy and smart factory applications.

Table 3: Number of 5G standard essential patents as to industry application over time

While table 3 looks at absolute numbers, table 4 calculates the share of 5G patents over time. While automotive that by far the largest share it is decreasing and especially IoT and smart energy applications have increasing 5G SEP declarations.

Table 4: Number of 5G standard essential patents as to share of industry application over time

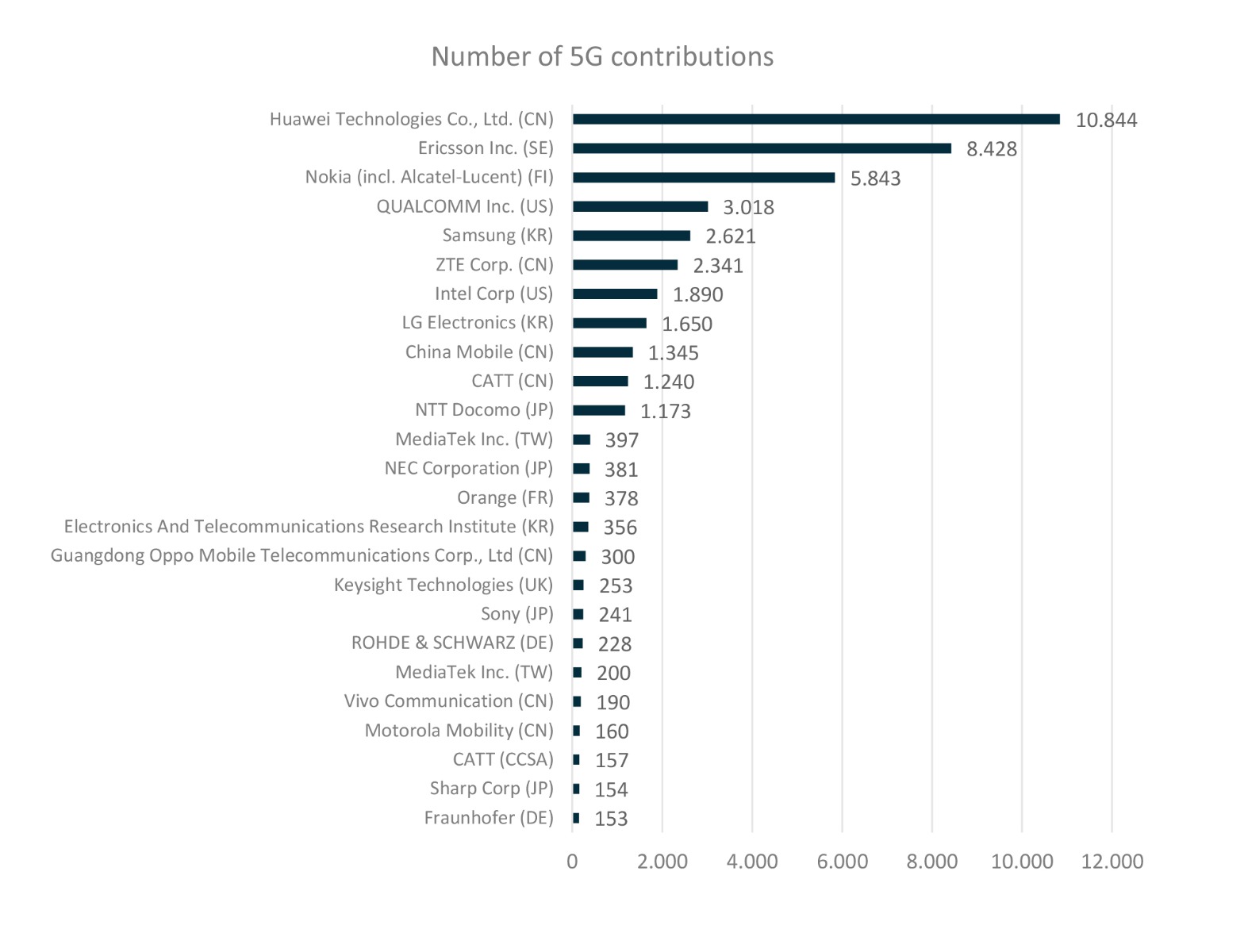

The interconnectivity of different systems and the communication across multiple devices relies on a common specification of the 5G standards. Standards development of complex technologies such as 5G therefore often integrates so many patented solutions. Beyond the patent data analysis, it is also worth taking a look at the companies which are

actively involved in the 5G standards development. The 5G standard is specified in international meetings where companies present and submit technical contributions. Using the database and analytics of the IPlytics Platform tool, table 5 shows the top companies that have submitted technical contributions to 5G. Again, the Chinese Huawei is responsible for most 5G contributions, followed by Ericsson, Nokia, Qualcomm and Samsung. NTT Docomo, NEC and Sony are the strongest Japanese 5G contributors.

Table 5: Top companies submitting technical contributions for 5G standards

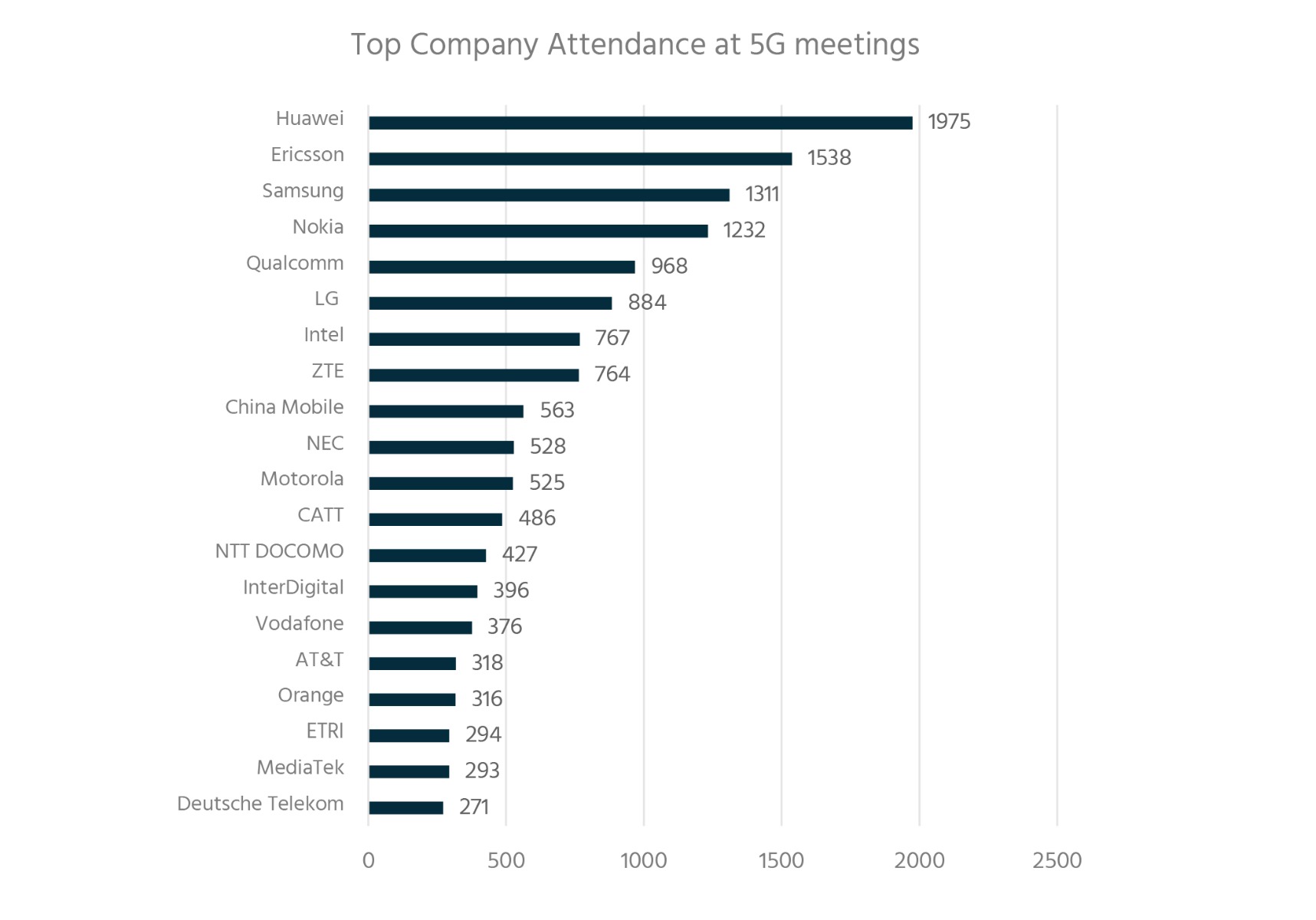

Another measure used to estimate involvement and investment in 5G standard development is the attendance of engineers at the standard setting meetings where 5G is developed. Attending these meetings reflects a company’s investment, as they send highly skilled technical engineers who commit their time to prepare, travel and discuss the latest 5G technologies. Using the database and analytics of the IPlytics Platform tool, table 6 illustrates the number of employees per company attending the 5G standard setting meetings.

Table 6: Top companies as to their attending employees at 5G meetings

Action plan:

The licensing of 5G standard essential patents looks set to become a major issue not only for the handset industry but for any manufacturing sector where connectivity will matter. Senior patent managers and patent directors should bear in mind some key considerations concerning 5G patents:

- Future technologies that enable connectivity will increasingly rely on patented technology standards such 5G.

- The number of 5G standard essential patents is constantly rising – patent directors should consider royalty costs and appropriate security payments in advance.

- Patent directors should not only consider information retrieved from patent data, but also monitor and consider standardization data such as technical contributions and meeting attendance to understand the landscape of 5G patent owners

- Senior patent managers should bear in mind the dynamic market of standard essential patents, where patent assertion entities often acquire patent portfolios to assert extensive royalty payments

- Manufacturers should pursue a common strategy for patenting and standardization to ensure that they are fully engaged in developing future connectivity technologies

Français

Français